LEIF

Stock Trading

LEIF

Real-time integration with exchanges and information providers

LEIF allows securities companies and banks to act directly in Nordic markets such as Nasdaq and NGM, or globally through various DMA services. The platform connects information services, market data and transaction flows with your core systems.

USE

Platform for transactions, market data, and integration

LEIF is used for the entire transaction flow, from receiving orders, to depot systems, and to managing trading shares, warrants, funds, and bonds. The platform provides real-time information and market data from external services such as Refinitiv and Morningstar and can be integrated with a variety of marketplaces and information services as well as your internal systems.

A major advantage of LEIF is that the platform minimizes future needs for change in the core systems as changes and adaptations are made in independent modules.

TRANSACTION FLOW

Manages the entire transaction flow from orders to deposit

LEIF is used for the entire transaction flow from order receipt and validation to closing management and integration with depot systems. LEIF is certified for Nasdaq INET Nordic, Nasdaq Genium INET, NGM Elasticia, SEB DMA, and Nordea DMA.

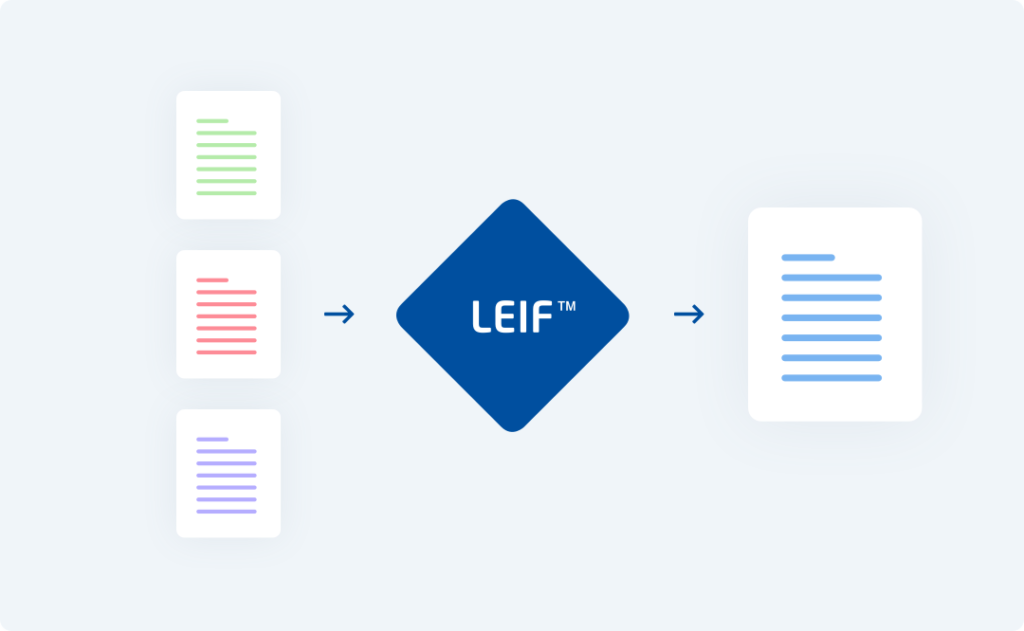

INTEGRATION

Integration platform between business and market place systems

LEIF is the integration platform between your business-critical systems and one or more marketplace systems. LEIF is protocol independent and handles information via all types of interfaces such as ISO, SWIFT, FIX, JSON, XML, and SQL. LEIF also monitors and manages published changes in interfaces with marketplaces and information providers.

PERFORMANCE

Built for high loads and stability och stabilitet

Stock trading places high demands on stability and performance. LEIF has been put to the test by the Nordic region’s largest financial players and handles hundreds of millions of transactions and price updates daily. This with a good margin as LEIF is built to handle a load of up to two billion messages per day and installation.

FEATURES

LEIF offers numerous powerful features

Ordering via fix

Against stock exchanges and DMAs in various types of listed securities such as shares, warrants, funds, and bonds

Holdings checks

Controls of holdings and reservations of securities or cash and cash equivalents

Trade towards online markets

Limit orders and trigger orders, such as stop-loss, and monitoring of order status

Obtaining of stock market closure

Conversion to ISO15022 for processing for clearing and settlement

Market information

Real-time information from Nasdaq Global Data Products, SIX, Refinitiv, Bloomberg, Morningstar, and Copp Clark

Integration

Independent of protocols and handles information via interfaces such as ISO, SWIFT, FIX, JSON, XML, and SQL

Certified

For Nasdaq INET Nordic, Nasdaq Genium INET, NGM Elasticia, SEB DMA, and Nordea DMA

High performance

Designed to handle up to two billion messages per day and installation