LISA

Online Platform

LISA

A start-ready, flexible and well-proven customer portal

Using our modern online platform LISA makes it easy and safe for your customers to trade in funds and securities. The platform has many ready-made modules that can be adapted and added with specific solutions for your unique needs – today and in the future.

EXAMPEL

Customer portal for banking and finance

Today, LISA is used by several international banks, securities companies, fund management companies, and stock exchanges that have high demands on customer experience, availability, and data security. Digital onboarding of new customers, KYC support with automatic calls to external registers, signing with Mobile BankID, digital consulting, and monthly savings with direct debit transactions are just some of the functions available on the platform. With a modern and intuitive interface, it will be easy for the customer to e.g. buy funds, see value development on holdings or manage monthly savings. The platform can be flexibly adapted and delivered in different packages – everything from a comprehensive customer portal to a specific module that fulfills a specific purpose. The LISA platform is a safe choice as we have more than 15 years of experience in taking overall responsibility for the development, management, and operation of customer portals in the financial sector.

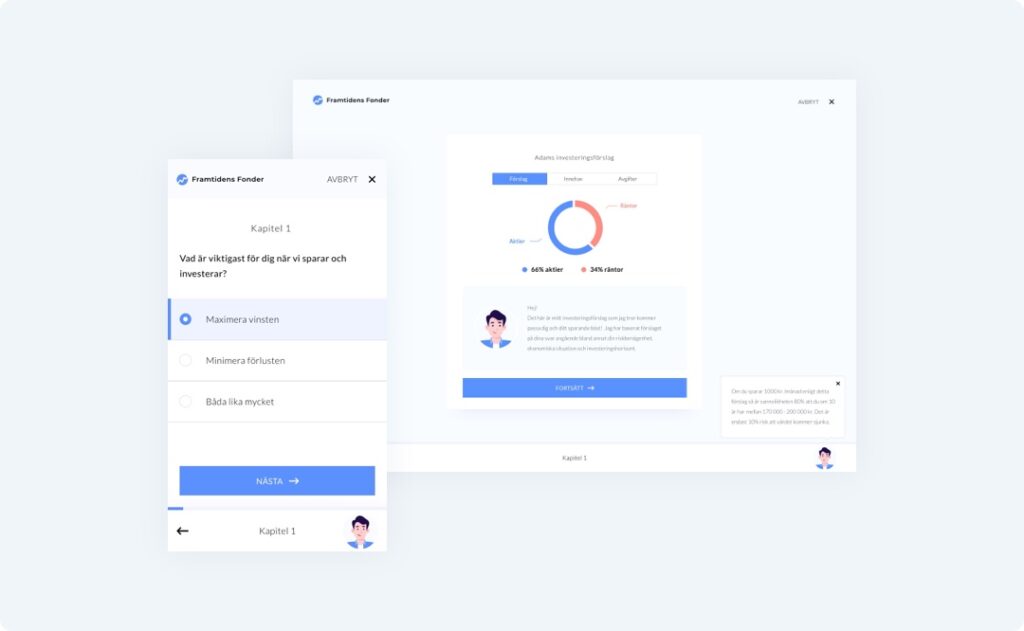

MODULE – DYNAMIC FORMS

New customer flow, KYC & digital consulting

With the Dynamic Forms module, you can build a flow of questions specific to your needs. The customer’s answers decide which questions or what information is presented. This means that you can easily create smart dialogues, for example for new customers onboarding, KYC, and digital consulting.

READ MORE

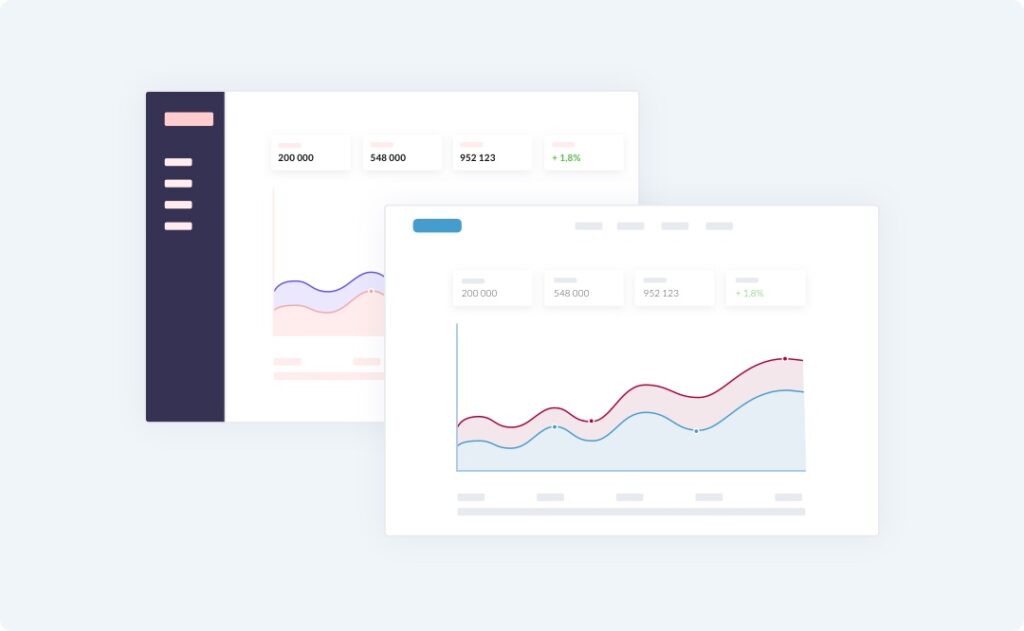

FINANCE – SECURITIES AND SECURITIES TRADING

Holdings, transactions, and reports

With the help of LISA, you can offer your customers a powerful customer portal so that they can manage their investments digitally, much like an Internet bank, but for mutual funds or securities. Holdings overviews, transactions, order placement, and reports are some of the basic functions of the platform.

READ MORE

GENERAL – CUSTOMER PORTAL

Customer portal for my sites

Raise your service level with a modern digital room – My Pages – for your customers, members, or partners. Regardless of the context, LISA is a secure, proven, startup platform. LISA is used by everything from global customers to startups in various industries.

READ MOREFEATURES

LISA offers a variety of powerful features

Login & e-id

Username/password, two-factor authentication, and BankID

User control

Automatic checking against e.g. Swedish Companies Registration Office, address retrieval, and PEP control

Deposit information

View custodian value, holdings, transactions, and portfolio reports

Autogiro (automatic withdrawal)

Manage concessions, one-time transfers, and monthly savings

Swish (real-time payments)

The customer can ”Swish” from his private account to his customer account

Dynamic forms

Digitize e.g. registration of new customers – no forms, no mailings

Mobile-app

Give the customer access to the service always, everywhere, and easily on the mobile

Digital signature

Customers can sign documents digitally with e.g. Mobile BankID – fast and paperless

LISA offers a variety of powerful features

Login & e-id

Username/password, two-factor authentication, and BankID

User control

Automatic checking against e.g. Swedish Companies Registration Office, address retrieval, and PEP control

Deposit information

View custodian value, holdings, transactions, and portfolio reports

Autogiro (automatic withdrawal)

Manage concessions, one-time transfers, and monthly savings

Swish (real-time payments)

The customer can ”Swish” from his private account to his customer account

Dynamic forms

Digitize e.g. registration of new customers – no forms, no mailings

Mobile app

Give the customer access to the service always, everywhere, and easily on the mobile

Digital signature

Customers can sign documents digitally with e.g. Mobile BankID – fast and paperless

Fund trading

Opportunity for your customers to place fund orders for buy, exchange, or sell

Stock trading

Manage stock trading with our (or someone else’s) real-time integrated stock exchange system

Integration

With our modern API, you can easily integrate LISA with other systems

Multilingual support

A single admin interface for managing all texts and languages

Recurring KYC

Combine dynamic forms and notifications to collect or remind KYC

Notifications

Send out notices via email or text messages to remind such as a password change or KYC

Reports

Ability to extract optional data and create reports in Excel and PDF format

PDF generation

Possibility to generate PDF documents for signing and archiving based on digital feeds

Roles & user rights

Configure your system with different roles, user rights, and permissions

Role-based homepage

Customize your system homepage based on the different roles of your users

Scheduled tasks

Schedule, trigger, and follow up on different types of runs

Digital advisor

Create a digital advisor with the help of questions that, depending on the answers, generate different results

Support tickets

Simplify and digitize your customer support, with everything gathered in one place

Payments

Integration with Swedbank’s SUS service for individuals or mass payments

Event log

All events that take place in the platform are registered in a common log

Customized appearance

Customize color and shape based on your graphic profile and brand